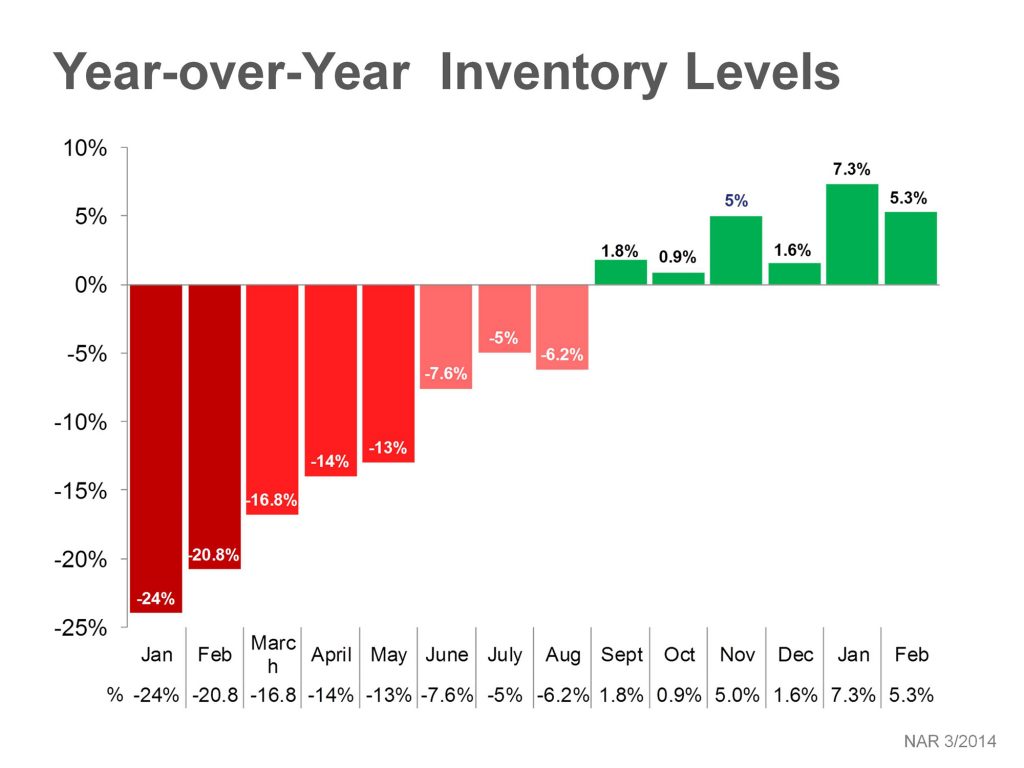

Little by little, inventory levels are increasing throughout the United States. Although levels are increasing, they are unfortunately not increasing fast enough to meet the demands of the housing market.

Year-over-year inventory shown in this graph shows the challenges we faced in 2013. Throughout the fourth quarter and this year’s first quarter, inventory has slowly begun to increase, but it will not be able to support the level of buyers who are waiting for warmer weather, especially in Wisconsin. Among current renters, homeowning aspirations are particularly strong, with 10% of renters indicating they would like to buy in the next year. This would represent more than 4.2 million first-time home sales, more than double the 2.1 million first-time home sales in 2013.

Year-over-year inventory shown in this graph shows the challenges we faced in 2013. Throughout the fourth quarter and this year’s first quarter, inventory has slowly begun to increase, but it will not be able to support the level of buyers who are waiting for warmer weather, especially in Wisconsin. Among current renters, homeowning aspirations are particularly strong, with 10% of renters indicating they would like to buy in the next year. This would represent more than 4.2 million first-time home sales, more than double the 2.1 million first-time home sales in 2013.

Month’s inventory, where the number of homes for sale could support home buyers for a certain number of months, is normally balanced at a six-month level. Currently the housing market is indicating five months, showing the growth of inventory in comparison to last year, but still unable to sustain buyers that will come to market in the next weeks and months. Distressed properties are continuing to disappear (See Distressed Property Rates Continue to Fall) and will not be replenishing the inventory levels as they have in the past. The housing market needs more home sellers to continue the recovery and growth of the past 18 months. If you’re looking to sell, don’t wait! With days on market dwindling, prices rising and mortgage rates still historically low, there is sure to be a buyer out there looking to buy your home.

Month’s inventory, where the number of homes for sale could support home buyers for a certain number of months, is normally balanced at a six-month level. Currently the housing market is indicating five months, showing the growth of inventory in comparison to last year, but still unable to sustain buyers that will come to market in the next weeks and months. Distressed properties are continuing to disappear (See Distressed Property Rates Continue to Fall) and will not be replenishing the inventory levels as they have in the past. The housing market needs more home sellers to continue the recovery and growth of the past 18 months. If you’re looking to sell, don’t wait! With days on market dwindling, prices rising and mortgage rates still historically low, there is sure to be a buyer out there looking to buy your home.

Tags: Q2, Quarterly Newsletter

Categories: Quarterly Newsletter

Leave a Reply